Picture this: you’re renovating your property, and suddenly, the word ‘asbestos’ enters the conversation. It’s not a word we often think about, but it can be a game-changer when it comes to your plans and budget. As a business owner, you might be concerned about the costs of removing asbestos. But what if I told you there’s a way to get some of that money back through tax relief? In this article, we’ll demystify asbestos, unravel the tax relief scheme, and show you how this financial lifeline can help you and your business.

What is Asbestos and what does it look like?

Asbestos used to hold a crucial role in our homes and workplaces; tiny fibres, almost invisible to the naked eye, but incredibly sturdy and heat-resistant. It was the go-to material in construction for years, making our buildings more robust and fireproof. However, it ended up being too good to be true – asbestos is also a silent threat to our well-being. It can lead to serious health issues, particularly respiratory problems such as Asbestosis and even Lung Cancer. Thus, was eventually completely banned in the UK by 1999. This ban wasn’t quite as simple though, as regulations were set in stone during the 1980s and over the course of the next decade, more prohibitions were put in place to minimise exposure to asbestos until it was labelled as a true danger to health. There’s a strong reason why this didn’t happen so quickly, as the effects of asbestos are not instant as it can take up to 50 years in some cases to begin seeing symptoms.

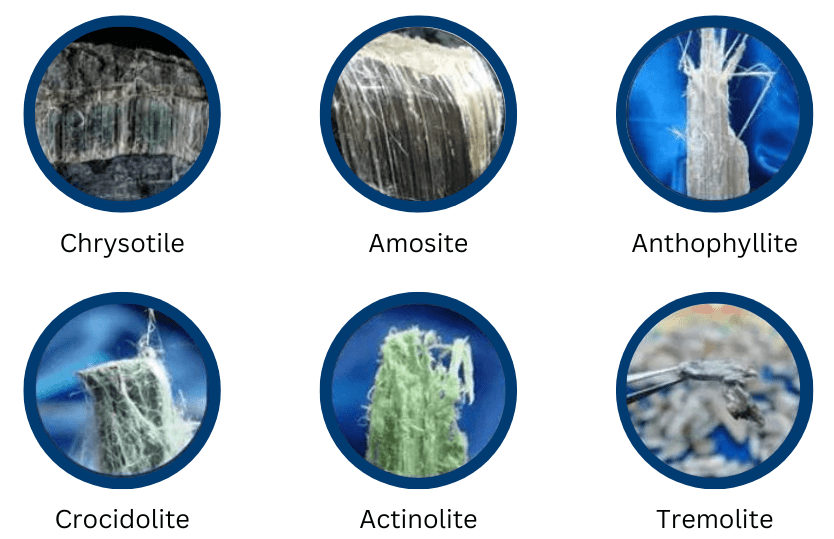

There are 6 common types of Asbestos in the UK:

Blue Asbestos (Crocidolite):

- Danger Level: Extremely High

- Blue asbestos is considered the most dangerous form of asbestos due to its thin, needle-like fibres, which can easily become airborne and inhaled. Prolonged exposure to crocidolite asbestos is associated with severe health risks, including a high risk of developing asbestos-related diseases.

Brown Asbestos (Amosite):

- Danger Level: Very High

- Amosite asbestos, while slightly less dangerous than crocidolite, still poses a significant health risk. Its thick, straight fibres can become airborne when disturbed, leading to health hazards if inhaled.

White Asbestos (Chrysotile):

- Danger Level: High

- White asbestos is the most common form, and although it’s considered less dangerous than blue and brown asbestos, it can still cause serious health issues. Its curly fibres can become airborne when materials containing chrysotile are damaged.

Anthophyllite:

- Danger Level: Moderate

- Anthophyllite asbestos is less common, which can reduce exposure risks. However, it is still considered moderately dangerous when disturbed.

Tremolite:

- Danger Level: Moderate

- Tremolite asbestos, often found as a contaminant, carries a moderate level of risk when airborne. Its presence in other asbestos materials increases the risk of exposure.

Actinolite:

- Danger Level: Moderate

- Actinolite asbestos is also considered moderately dangerous. It can be found in a variety of colours, including dark green to black, and poses risks when its fibres become airborne.

Although most forms of asbestos have been removed from a large amount of buildings within the UK, many still have this culprit laying around, hiding in walls and roofing. But what’s the connection between this material and your finances?

The government introduced a clever scheme back in 2001. It’s like a hidden treasure map for businesses dealing with asbestos. Here’s the deal: if you’ve had to remove Asbestos Containing Materials (ACMs) from a building or property, you’re in line for a tax rebate. How does this work? It’s a 150% tax rebate. To put it plainly, if you spent, say, £10,000 on asbestos removal, you can knock off £15,000 from your taxable income. That’s real cash back in your pocket. No tricks, no gimmicks, just smart financial relief. This financial lifeline is here to ease the burden, and in some cases, even help your business turn a profit.

However there is one caveat; if your company owned the property when the asbestos was first put in, you won’t be eligible for the rebate. So, it’s not a one-size-fits-all deal, but for many, it’s a golden opportunity to reduce costs and make your budget work better for you.

How the scheme works in practice

Step 1: Identifying Asbestos

The journey begins by identifying the asbestos in your building. This typically involves asbestos surveys and assessments. The aim is to pinpoint where the asbestos is, its type, and its condition. It’s like a detective mission, only with the goal of making your property safe.

Step 2: Asbestos Removal

Once you know where the asbestos is, the next step is removal. Trained professionals will safely remove the hazardous materials, ensuring minimal disruption to your operations. This must not be done without the proper PPE.

Step 3: Calculating Expenses

As the removal process unfolds, expenses start adding up. This includes the costs of hiring professionals, specialised equipment, and disposal. You’ll want to keep meticulous records of these expenses to make the most of the tax relief opportunity.

Step 4: Tax Relief Claim

With the asbestos out of the picture, it’s time to claim your tax relief. Your business can deduct 150% of the expenses incurred from your taxable income. This can make a substantial difference in your overall financial outlook. This can be presented in your tax return for the financial year. It is important though, to seek advice from a professional in taxation or accountancy to make sure you’re not making any mistakes and going through the process seamlessly.

At Springfield Steel Buildings, we can help with asbestos removal and issues during construction or demolition of a steel building. Contact us today to learn more.